- LOGIN

- MemberShip

- 2026-03-10 00:57:00

- Policy

- Pharma exports surpassed $10 billion threshold

- by Lee, Jeong-Hwan Mar 04, 2026 05:41pm

- Lee Hyung-hoon, Second Vice Minister of MOHWIn 2025, South Korea's bio-health industry export sales reached a record high of KRW 27.9 billion. The Ministry of Health and Welfare (MOHW) met with exporting companies to listen to industry voices and gather opinions on support measures.Notably, pharmaceutical exports surpassed the $10 billion threshold for the first-time last year, recording $10.4 billion.This figure represents an approximately ten-fold increase over the past ten years as biopharmaceuticals, which account for 62.6% of pharmaceutical exports, expanded their export markets, focusing on the United States and Europe.Lee Hyung-hoon, Second Vice Minister of MOHW, held a corporate briefing on the activation of bio-health industry exports at City Tower in Seoul at 2:00 PM on the 3rd. Lee encouraged the efforts of export company officials and promised to strengthen support.After sharing industry trends, Vice Minister Lee sought government support measures by listening to difficulties in the field.Among pharmaceutical companies, Samsung Biologics, GC Biopharma, HK inno.N, and Alteogen attended. In the medical device field, CGBio, Vuno, Meerecompany, and Wontech attended.The briefing began with presentations on the 2026 outlook and export activation support plans, followed by officials from each exporting company presenting the difficulties they face and proposed policy improvement measures. It concluded with a free discussion for all attendees.◆2025 export performance=Last year, the export value of the bio-health industry, including pharmaceuticals, biotech, medical devices, and cosmetics, reached $27.9 billion, an increase of 10.3% compared to the previous year, despite uncertain conditions such as tariffs. This recorded an all-time high and ranked 8th among South Korea's major industries.Specifically, in terms of last year's performance by major industry, semiconductors ranked first with $173.4 billion, followed by automobiles at $72.0 billion, general machinery at $46.9 billion, petroleum products at $45.5 billion, petrochemicals at $42.5 billion, ships at $31.8 billion, steel at $30.3 billion, and bio-health at $27.9 billion.Notably, pharmaceuticals surpassed $10 billion for the first time, recording $10.4 billion in exports and achieving their highest-ever performance.This is the result of biopharmaceuticals, which account for 62.6% of pharmaceutical exports, expanding their markets in the United States and Europe and increasing approximately tenfold over the past decade.By country, the United States, Switzerland, and Hungary were the major countries for exports, accounting for 39.5% of total exports and showing steady increases centered on advanced markets.The export value of biopharmaceuticals grew from $670 million in 2015 to $3.49 billion in 2020, and further increased approximately tenfold to $6.52 billion last year.Medical devices, including in-vitro diagnostic devices, shifted back into a recovery trend, and general medical devices also made progress with steady growth. By country, the United States, China, and Japan accounted for 33.1% of total exports, maintaining the top three positions.◆2026 export outlook=The MOHW announced an export target for the bio-health industry of $30.4 billion, a 9.1% increase compared to last year.This year's goals are $11.7 billion for pharmaceuticals (+12.4%), $6.2 billion for medical devices (+2.7%), and $12.5 billion for cosmetics (+9.5%).In pharmaceuticals, domestic biopharmaceuticals are expected to lead export growth, driven by the global expansion of the biopharmaceutical market and South Korea's position as the world's number one in Contract Development and Manufacturing Organization (CDMO) capacity.This is the outcome of the current status for biosimilar development following the patent expirations of 58 original biopharmaceuticals through 2032, and the encouragement of biosimilar prescriptions in the United States and the EU.In medical devices, export expansion is expected in advanced and emerging markets for ultrasound imaging diagnostic devices and X-ray equipment incorporating AI technology, as they increase diagnostic accuracy and efficiency, in line with trends in aging populations and the AI transition.To support export activation, the MOHW will invest KRW 233.8 billion, a 3.5-fold increase from last year, to overcome export uncertainties and actively foster the bio-health industry through investment promotion, supply chain strengthening, overseas regulatory response, consulting, marketing, and the establishment of local bases. ◆Pharmaceutical and bio field=The MOHW will strengthen competitiveness by creating an investment environment. Based on industry suggestions and analysis of past performance, the ministry will promote improvements to the innovative pharmaceutical company certification system for companies with excellent R&D investment and continue to form a KRW 1 trillion mega-fund to ensure that domestic drug pipeline-based new drugs reach global commercialization.Specifically, a new specialized fund of KRW 150 billion will be established this year to support Phase 3 clinical trials, which require the most capital during new drug development, and more than KRW 1 trillion in national health and medical R&D will catalyze expanding private R&D investment.The MOHW will also revitalize the industrial ecosystem by strengthening the pharmaceutical supply chain. To prepare for supply chain crises, the ministry will prepare an integrated stabilization response system, including securing raw materials and parts, supporting production facilities for drugs with unstable supply, and supporting the stockpiling of core medicines.First, it will support the stabilization of new biomaterials) and expand support for diversifying new raw material purchases (10 companies, KRW 1.5 billion). It will also support the production of drugs with unstable supply (4 companies, KRW 3.8 billion), the stockpiling of new core medicines (5 companies, KRW 500 million), and the advancement of manufacturing for new promising export medicines (15 companies, KRW 8.1 billion).To strengthen support for global entry and export diversification, the goal is to move beyond the generic and biosimilar stages that have been the center of the pharmaceutical industry and enter the global market, with a focus on innovative new drugs.The ministry plans to strengthen full-cycle support, including 'open innovation' based on cooperation, 'consulting,' the operation of domestic accelerator programs (inbound), and key global market entry (outbound).The "K-Biopharma Next Bridge" project will be introduced to facilitate collaboration between domestic companies with promising technologies and global leading companies with high interest in the Korean market. Open innovation growth programs will be operated one-by-one, and the provision of information on regulatory changes by country and consulting for patent, legal, tax, customs, and distribution channel diversification will be strengthened.Domestically, an accelerator program will be operated to increase the commercialization success rate of technology-based startups, support for companies occupying the Boston CIC to establish a bridgehead for US market entry will be expanded from 30 to 40 companies, and various networking activities to secure global sales channels will be strengthened through export consultations, the dispatch of market pioneer groups, and support for participating in global medical societies.◆Medical device =An innovation ecosystem will be created to strengthen competitiveness, centered on the Medical Device Comprehensive Support Center, which covers the entire cycle from R&D to commercialization and overseas entry. Utilizing the Medical Device Comprehensive Information System and MDCC, the MOHW will strengthen customized consulting support for companies and provide more professional information.The Medical Device Consulting Council (MDCC) consists of 202 external experts in eight fields, including licensing and systems, R&D and clinical trials, overseas entry, commercialization, and legal and accounting.Furthermore, the ministry will strengthen technology verification and market linkage for domestic companies through the global open innovation program "New Impact Korea," which promotes cooperation with global companies, hospitals, and investment institutions.By holding "MedTech Insight," which systematically provides industry trends, regulations, and market information, the ministry will support the development of strategies aligned with field demand and lay the foundation for sustainable growth in the domestic medical device industry.To increase the export potential of the domestic medical device industry, new projects to strengthen competitiveness will be expanded.Support will be provided for the commercialization of innovative technologies and the strengthening of the competitiveness of the next-generation surgical robot industry, including support for the rapid commercialization of AI-applied products and the construction of an AI-based surgical robot innovation lab from 2026 to 2030.Additionally, the MOHW will support clinical trials and real-world evaluations through professional consulting and medical staff matching by operating six hospital-based demonstration support centers this year, thereby facilitating the acquisition of clinical evidence and market entry in domestic and overseas markets.To strengthen market-tailored export support, specialized support for major overseas markets will be increased. To facilitate local-based global entry cooperation, the ministry will support 10 companies in the US bio cluster in Houston with company occupancy and provide up to KRW 200 million per company annually to cover regulatory response costs essential for overseas market entry.The MOHW will also help secure stable sales channels by supporting marketing and auxiliary export costs amid uncertainties in the international supply chain.Furthermore, from this year, the "Medical Device Global Education and Training Support" project for overseas medical staff will be promoted to expand experience with key Korean products through linked education with overseas medical institutions, training facilities, and international medical societies, thereby strengthening product reliability and the foundation for market expansion.

- Policy

- GMP “one-strike” rule to be eased… suspension introduced

- by Lee, Jeong-Hwan Mar 03, 2026 09:21am

- The National Assembly and the government are launching a comprehensive overhaul of the “one-strike out” (immediate revocation) system for pharmaceutical GMP (Good Manufacturing Practice) compliance violations.This approach introduces an intermediate regulatory step: adding a ‘GMP suspension’ penalty before immediate revocation, depending on the severity of violations related to the manufacturing record. The suspension period can be set for up to 6 months.At the same time, a new provision will mandate immediate revocation of GMP certification for companies that fail to prepare, properly retain, or intentionally discard GMP records, equating such conduct with obtaining certification through false or fraudulent means.The reform aims to address concerns that the current system, which focuses heavily on the ‘repeated nature’ of GMP manufacturing record violations by pharmaceutical companies, has led to some unreasonable penalties.On the 27th, Rep. Jongheon Baek of the People Power Party and Rep. Mi-hwa Seo of the Democratic Party of Korea jointly introduced amendments to the Pharmaceutical Affairs Act to rationalize GMP regulations.The bipartisan push for legislation to improve the GMP one-strike-out system was influenced by the Ministry of Food and Drug Safety (MFDS) commissioning and completing a research project based on industry complaints.Previously, amid incidents involving unauthorized manufacturing and falsified GMP records, the MFDS and the National Assembly strengthened GMP sanctions to prevent recurrence.As a result, the one-strike-out system for GMP compliance violations of pharmaceutical companies was implemented in December 2022 following National Assembly legislation.However, since the law's enactment, pharmaceutical companies whose GMP certifications were revoked by the MFDS have repeatedly filed administrative lawsuits challenging the decisions. As shortcomings in the system became apparent, calls for improvement emerged from both the pharmaceutical industry and the National Assembly.Complaints frequently arose that immediate revocation of GMP certification not only halts a pharmaceutical company's drug production lines but also causes significant operational damage to contract manufacturers tied to the penalized company, necessitating pre-revocation regulatory measures.Specifically, pharmaceutical companies criticized the current GMP one-strike-out system as excessive punishment. They argued it applies the criterion of ‘repeated false or erroneous record-keeping’ without considering the severity of the violation (such as falsifying manufacturing records), its impact on human health, or the presence of intent.Pharmaceutical companies pointed out that focusing solely on repetition for GMP certification revocation can result in lighter penalties for serious violations compared to minor infractions and does not adequately account for intent.Consequently, some companies reportedly resorted to intentionally not preparing or discarding GMP records to avoid revocation triggered by repeated documentation errors.In response, the MFDS initiated a research project on the GMP compliance certification system and advanced supplementary legislation in collaboration with the National Assembly.The core revision introduces ‘GMP certification suspension’ as an intermediate sanction between corrective orders and full revocation. This penalty will be applied based on the severity of the GMP violation and its impact on drug quality.Notably, companies that fail to prepare or retain GMP records will face immediate revocation, targeting attempts to evade penalties through deliberate non-documentation or record destruction.Additionally, a new intermediate regulatory measure was established, allowing for a 6-month suspension of GMP certification for relatively minor GMP violations.The MFDS and lawmakers Jong-heon Baek and Mi-hwa Seo, who proposed the bill, plan to collaborate on advancing GMP certification revocation regulations through swift legislation.

- Policy

- Will pharma be able to request 'records of administrative sanctions' during acquisition?

- by Lee, Jeong-Hwan Mar 03, 2026 09:21am

- A bill is being developed to grant pharmaceutical manufacturers that intend to acquire an existing pharmaceutical company the authority to request and receive records of administrative sanctions imposed on the previous owner (the former operator) by administrative authorities.This legislation aims to address the issue that the current law lacks a legal basis for an assignee to verify the assignor's history of administrative sanctions.Once the bill is passed, cases in which an assignee suffers unfair losses, such as managerial damage, by acquiring a pharmaceutical company without knowledge of existing administrative sanctions are expected to disappear.On February 27, 2026, Representative Park Hyeong-soo of the People Power Party proposed a partial amendment to the Pharmaceutical Affairs Act containing these details.Under the current law, when a new operator succeeds to the status of a former operator through business transfer, inheritance, or merger between corporations, the effects of administrative sanctions on the former operator are transferred to the assignee, except for cases of good faith acquisition.In other words, if a pharmaceutical company with finalized administrative sanctions is purchased, the responsibility and effects of those sanctions are transferred to the assignee rather than the assignor.Rep. Park raised concerns that if a pharmaceutical company is acquired without knowledge of any administrative sanction history, the assignee is forced to fulfill the existing sanctions, which can sometimes lead to a situation worse than not having acquired the company at all.Accordingly, Rep. Park introduced a bill that allows a person seeking to succeed to a pharmaceutical manufacturing business (a person intending to acquire a pharmaceutical company) to request the history of past administrative sanctions and details of administrative sanctions currently in progress from the Minister of Health and Welfare (MOHW), the Minister of Food and Drug Safety (MFDS), provincial governors, or heads of local governments (mayors, governors, or district heads).Rep. Park explained, "This bill allows assignees to check the records of administrative sanctions against the previous operator in advance, enabling them to make more rational decisions regarding the acquisition," adding, "The Anti-Corruption and Civil Rights Commission has also recommended establishing procedures to verify administrative sanctions, as cases of attempting to transfer businesses to evade administrative sanctions have become frequent."

- Policy

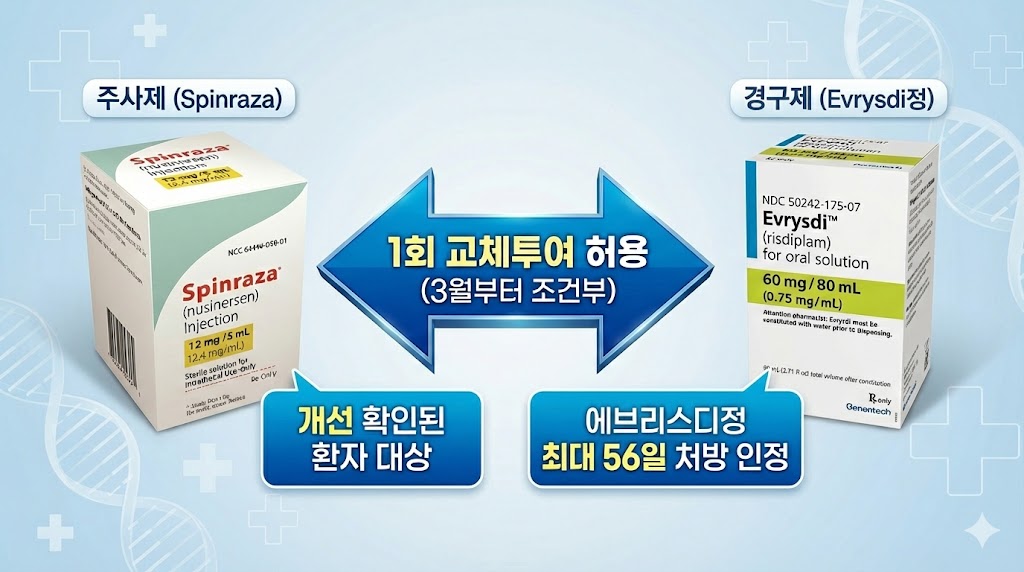

- Reimb for switching between Evrysdi and Spinraza allowed in Korea

- by Jung, Heung-Jun Mar 03, 2026 09:21am

- Beginning in March, the scope for switching between spinal muscular atrophy (SMA) treatments Evrysdi and Spinraza will be expanded with reimbursement.With bidirectional switching now permitted between injectable and oral therapies, prescriptions can be adjusted based on changes in patient condition. Previously, only a single switch from Spinraza to Evrysdi had been allowed.AI-generated ImageOn the 27th, the Health Insurance Review and Assessment Service (HIRA) announced updated reimbursement criteria for SMA therapies, effective March 1, following revisions to the Ministry of Health and Welfare’s reimbursement standards.Until now, switching or combination therapy between SMA treatments had not been covered. Under the revised policy, a one-time conditional switch will be permitted between the injectable Spinraza and the oral formulations Evrysdi Dry Syrup and Evrysdi Tab.Switching is allowed if clinical improvement has been confirmed during treatment, the discontinuation criteria are not met, and there is a valid clinical reason. This applies not only to switching from an injectable to an oral medication but also from an oral medication to an injectable. Patients can even switch from an injectable to an oral medication and then return to an injectable.The change enhances treatment accessibility by allowing reimbursement coverage when medication adjustments are necessary based on a patient’s condition.However, patient motor function assessment criteria have become more detailed. Previously, assessment tools were applied uniformly based on whether the patient was under or over 24 months of age.Starting in March, assessment tools will instead be differentiated based on whether the patient can sit, among other refinements. This will apply to assessments conducted after implementation.With the new reimbursement listing of Evrysdi Tab in March, long-term prescription limits have also been established. The maximum prescription duration for Evrysdi Tab is 56 days.Roche Korea’s Evrysdi Tab 5mg is scheduled for reimbursement listing next month at KRW 793,333, adding a tablet formulation alongside the existing dry syrup.With the addition of a new formulation, the wording has been revised to refer to ‘Evrysdi Dry Syrup, etc.’ in prior review procedures and reimbursement criteria to reflect the expanded formulations.

- Policy

- MOHW to newly establish 'Bureau of Regional·Essential·Public Healthcare'

- by Lee, Jeong-Hwan Mar 03, 2026 09:21am

- 고형우 국장The Ministry of Health and Welfare (MOHW) plans to complete the establishment of the 'Bureau of Regional·Essential·Public Healthcare' within the first half of this year. The Office of the President agrees with the necessity of strengthening 'Bureau of Regional·Essential·Public Healthcare,' and the Ministry plans to create a new bureau following consultations with the Ministry of the Interior and Safety.On the 2nd, Ko Hyung-woo, Director of the Division of Essential Healthcare at the MOHW, shared these plans during a briefing with the Korea Special Press Association.Director Ko explained that the new division is still in its early stages and requires further coordination with the Ministry of the Interior and Safety.However, he added that discussions are in full swing following the passage of the Regional Essential Healthcare Act in the National Assembly, and that the Office of the President is responding positively.Consequently, the Ministry intends to establish the new Division-level organization during the first half of the year to take full charge of the new healthcare policies.Ko stated, "While the 'Bureau of Regional·Essential·Public Healthcare' will include three distinct bureaus (Regional Healthcare, Essential Healthcare, and Public Healthcare), we will not be creating all new divisions," adding, "Some will be reorganized and recombined from existing structures."Ko added, "Bureaus that require new establishment, such as those related to national medical schools, will be created. I hope that the workforce will increase under this new Bureau-level structure. The healthcare sector is short-staffed. If sufficient personnel are deployed, the quality of our policies will be significantly higher than it is now."Regarding the allocation of KRW 1.13 trillion annually for the Regional and Essential Healthcare Special Account, Director Ko said, "If we design our projects well, we can pull budget from other general finances if necessary. Therefore, the KRW 1.13 trillion is not set but it could increase or decrease."Ko emphasized, "The important part is our decision to proceed with KRW 800 billion for new projects. Typically, projects exceeding KRW 50 billion over five years must undergo a preliminary feasibility study, which takes considerable time and would prevent immediate implementation next year," adding, "Since KRW 800 billion over five years totals KRW 4 trillion, we must apply for an exemption from the preliminary feasibility study for this KRW 4 trillion plan. We are putting efforts into developing the content for this."Ko further explained, "According to our surveys of local governments, the majority believe that support is essential for childbirth, pediatrics, emergency, and cardiovascular care," adding, "While medical personnel represent the most critical portion of the KRW 800 billion budget, regional doctors will not emerge for another 10 years. Therefore, we are currently considering how to address non-physician medical personnel."

- Policy

- Erleada Tab's expanded reimbursement bid falls through

- by Jung, Heung-Jun Feb 27, 2026 08:36am

- Expanded reimbursement for Janssen Korea's Erleada (apalutamide), a treatment fors prostate cancer, fell through due to failed negotiations between the company and the National Health Insurance Service (NHIS).Erleada Tab has encountered a hurdle requiring a refund rate adjustment due to expanded reimbursement, as it is designated a Risk-Sharing Agreement (RSA) medicine. Janssen Korea plans to prepare for reapplication to expand the drug's reimbursement.According to industry sources on the 24th, Erleada Tab recently failed to clear the final hurdle in price negotiations with the National Health Insurance Service (NHIS), the last step before receiving expanded reimbursement.Erleada Tab was approved for reimbursement for treating 'metastatic hormone-sensitive prostate cancer' (mHSPC) in April 2023. It was listed at KRW 20,045 under a refund-type Risk-Sharing Agreement. Additionally, it became the first in the Androgen Receptor Targeted Agent (ARTA) to receive essential reimbursement, with a 5% patient co-payment.Then, the company applied to expand reimbursement to 'treatment of patients with high-risk non-metastatic castration-resistant prostate cancer (nm CRPC)', which was approved by the Cancer Disease Review Committee (CDRC) in March last year. In October of the same year, the Drug Benefit Evaluation Committee recognized the adequacy of this drug's expanded reimbursement.However, the issue appears to be the contract regarding the RSA refund rate associated with the expanded prescription target, and they ultimately failed to narrow the gap in their positions during negotiations.Janssen Korea stated, "Although these negotiations fell through, we plan to apply for expanded reimbursement again as soon as possible by following the procedures for re-initiating expanded reimbursement. We will continue to strive to improve treatment accessibility for patients."According to the pharmaceutical market research firm UBIST, Erleada Tab's prescription volume last year reached KRW 53.3 billion, a 71% increase from KRW 31.2 billion the previous year. Since receiving reimbursement for mHSPC in 2023, the drug has shown steep annual revenue growth.Competing products for Erleada Tab include Astellas' Xtandi (enzalutamide), indicated for high-risk nmCRPC, followed closely by Bayer's Nubeqa (darolutamide).In December last year, Nubeqa passed the first hurdle of the CDRC for establishing reimbursement criteria for ▲treatment of high-risk nmCRPC ▲combination with androgen deprivation therapy (ADT) for mHSPC patients ▲combination therapy with docetaxel and ADT for mHSPC patients.

- Policy

- Flexible pricing extended to listed drugs…boosts new drug exports

- by Jung, Heung-Jun Feb 27, 2026 08:36am

- The government’s decision to expand the dual-pricing “flexible pricing agreement scheme” to already-listed drugs is expected to support the global expansion of Korean new drugs.With the broader application of the scheme, cases like HK Inno.N’s K-CAB are likely to increase. Domestic pharmaceutical companies preparing for exports are already gearing up for the expansion.On the 25th, the MOHW decided at the Health Insurance Policy Deliberation Committee (HIPDC) to push to expand the flexible drug pricing scheme in the first half of this year to enhance the global competitiveness of new drugs.The Medical Care Benefit Rules will be revised to expand the flexible drug pricing contract system, currently applied to ‘new drugs developed by innovative pharmaceutical companies, etc.’, to cover ‘new drugs and biosimilars, etc.’.AI-generated imageAlthough the eligible products were not specified in detail, already-listed medicines are included among the targets.This means that Korean new drugs with established reimbursement ceiling prices will also qualify. Contracting a higher official listed price can work favorably when setting prices for exports.K-CAB, for example, had been subject to a price reduction under the price-volume agreement system, but maintained its listed price through negotiations with the NHIS. While not a treatment for severe diseases, the product’s expanding overseas exports meant that a price cut would have had significant repercussions.As the only Korean new drug granted dual pricing (flexible pricing), K-CAB was able to preserve competitiveness in overseas price negotiations.An industry official at the domestic pharmaceutical company A commented, “For listed medicines, the ceiling price is already visible, but if a product is being prepared for export, raising the listed price is highly beneficial. The domestic listed price serves as a reference when determining prices abroad. Companies are already expecting the inclusion of already-listed medicines and already preparing for this.”Because biosimilars are also included in the expanded scope, Korean companies such as Celltrion and Samsung Bioepis are likewise expected to benefit from expanding their global sales channels.Above all, the greatest beneficiaries are multinational pharmaceutical companies' new drugs and patients with rare and severe diseases. Maintaining a higher listed price in Korea helps avoid disrupting global drug pricing policies, thereby reducing the risk of “Korea passing” in launch strategies.The HIPDC materials also include plans to “continuously improve cost-effectiveness evaluations to better reflect the innovation and value of new drugs,” suggesting that access to new drugs from multinational pharmaceutical companies will likely improve further this year.

- Policy

- COVID-19 pill now limited to 'Paxlovid'… Lagevrio stock depleted

- by Lee, Jeong-Hwan Feb 27, 2026 08:36am

- From now on, oral COVID-19 treatments will be limited to 'Paxlovid.' This is due to the stock exhaustion of Lagevrio, another oral antiviral, which will lead to its discontinuation starting on the 17th of next month.On the 26th, the Korea Disease Control and Prevention Agency (KDCA, Commissioner Seung-Kwan Lim) announced that, since the government-supplied stock of Lagevrio has been depleted, the available oral treatments for COVID-19 will be restricted to Paxlovid only.Originally, among the three COVID-19 treatments supplied by the government (Paxlovid, Lagevrio, and Veklury), Paxlovid and Veklury received marketing authorization and have been covered by Nationa Health Insurance since October 25, 2024.Lagevrio's marketing authorization process has not been completed and has maintained only Emergency Use Authorization (EUA) to date. While it continues to be supplied on a limited basis using government inventory, its shelf life has expired, and its use will be discontinued starting from the 17th of next month.Paxlovid is used for mild-to-moderate patients among the elderly (aged 60 and over), those with underlying medical conditions, and immunocompromised individuals. Patients for whom Paxlovid administration is restricted typically use Lagevrio or Veklury.Once Lagevrio use is discontinued, patients previously eligible for Lagevrio can use Veklury. Clinics will need to refer patients restricted from Paxlovid to hospitals where Veklury can be administered.Meanwhile, the approval scope of Paxlovid was recently expanded by the Ministry of Food and Drug Safety (MFDS) to include patients with severe renal impairment, including those on dialysis (as of January 14).Patients with severe renal impairment, who were previously used to taking Lagevrio because Paxlovid was not recommended, can now be administered Paxlovid through dose adjustment. Consequently, it is expected that a significant number of patients who previously received Lagevrio due to difficulties in prescribing Paxlovid will now be able to transition to Paxlovid.The government is preparing measures to improve prescribing convenience at medical institutions to facilitate the use of Paxlovid, which will become the sole oral treatment available.Paxlovid involves some inconvenience in clinical settings because of the need to verify the patient's use of contraindicated drugs (40 types).To expand the use of Paxlovid among those taking contraindicated drugs, the KDCA plans to distribute pamphlets providing detailed guidance based on the marketing authorization (such as suspending the drug in question or prescribing alternative medications).

- Policy

- Novo Nordisk’s next-gen obesity drug enters Korean trials

- by Lee, Tak-Sun Feb 27, 2026 08:35am

- AI-generated imageNovo Nordisk, the developer of the obesity treatment Wegovy (semaglutide), will conduct multinational Phase III clinical trials for its next-generation obesity therapy in Korea.The candidate is amycretin, the company’s next-generation obesity treatment candidate , with the company aiming for global commercialization through multinational trials.On the 24th, the Ministry of Food and Drug Safety (MFDS) approved two Investigational New Drug (IND) applications for Novo Nordisk’s NNC0487-0111.One is a Phase IIIa trial (AMAZE 2) evaluating the efficacy and safety of once-weekly NNC0487-0111 s.c. in subjects with overweight or obesity and type 2 diabetes. The other is a Phase IIIb clinical trial (HF-POLARIS) evaluating the efficacy and safety of NNC0487-0111 versus placebo on morbidity and mortality in patients with obesity and heart failure with preserved or mildly reduced ejection fraction.NNC0487-0111 is the development code for amycretin, which is being developed by Novo Nordisk.Amycretin is a next-generation obesity treatment with a dual mechanism of action: it stimulates the GLP-1 receptor like Wegovy, while also acting on the pancreatic hormone amylin, which is involved in appetite regulation.Novo Nordisk is developing amycretin in both a once-weekly injectable formulation and a once-daily oral formulation. In earlier clinical trials, amycretin demonstrated up to 24.3% weight reduction over 36 weeks of subcutaneous administration.Based on these results, Novo Nordisk plans to conduct a multinational Phase III trial starting this year. Commercialization is expected after 2028. South Korea is included in the global, multi-national Phase III trial network.In Korea, the planned enrollment is 155 patients for HF-POLARIS (global total: 5,610) and 60 patients for AMAZE 2 (global total: 630).HF-POLARIS will be conducted at Wonju Severance Christian Hospital, Seoul National University Hospital, Chungnam National University Hospital, Gachon University Gil Medical Center, Pusan National University Yangsan Hospital, Inha University Hospital, Ajou University Hospital, Samsung Medical Center, Severance Hospital (Sinchon), Seoul National University Bundang Hospital, Keimyung University Dongsan Medical Center, Seoul St. Mary’s Hospital, Korea University Ansan Hospital, Seoul Asan Medical Center, and Hallym University Sacred Heart Hospital.AMAZE 2 will take place at Kyung Hee University Medical Center, Chonnam National University Hospital, Seoul Asan Medical Center, Seoul National University Hospital, Seoul National University Bundang Hospital, Yeouido St. Mary’s Hospital, and Severance Hospital (Sinchon).Novo Nordisk’s development of amycretin is viewed as a strategic move to maintain competitiveness in the GLP-1 obesity treatment market.In Korea, Wegovy and Eli Lilly’s Mounjaro have formed a two-horse race. Wegovy, approved by the MFDS in 2023, recorded domestic sales of KRW 467 billion last year, according to IQVIA.Mounjaro, which targets both GIP and GLP-1 receptors, was launched in Korea in the second half of last year and generated KRW 215.5 billion in sales. The two companies continue to compete globally, including through the development of oral obesity treatments.

- Policy

- Opposition boycott puts pharmacy and drug bills on hold

- by Lee, Jeong-Hwan Feb 26, 2026 07:48am

- On the 24th, the main opposition party, the People Power Party, decided to launch a filibuster on all bills submitted for consideration, along with a full boycott of standing committee proceedings, in response to the Democratic Party’s unilateral push to proceed with a plenary session.As a result, the meetings of the 1st and 2nd Subcommittees of the Legislation and Judiciary Committee of the National Assembly’s Health and Welfare Committee, originally scheduled for the 25th and 26th this week, now face uncertainty regarding whether they will convene.Particularly for Subcommittee 1, chaired by People Power Party lawmaker Miae Kim, the atmosphere suggests it is highly unlikely to convene.While some within the ruling party have suggested holding a plenary session alone to review Subcommittee 1's bills, unilaterally reviewing and passing livelihood bills would inevitably invite criticism for bypassing established inter-party consensus procedures.If Subcommittee 1 fails to convene, bills expected to be tabled, including legislation on limited international nonproprietary name (INN) prescribing for drugs facing supply instability or designated as nationally essential medicines, as well as bills regulating the labeling, advertising, promotion, and establishment scale of warehouse-style pharmacies, would lose their opportunity for review.This would effectively delay the examination of livelihood-related legislation within the Health and Welfare Committee due to ongoing partisan conflict.Meanwhile, the 2nd Subcommittee of the Legislation and Judiciary Committee, chaired by Democratic Party lawmaker Sujin Lee, could theoretically proceed without participation from the People Power Party. Among its jurisdiction is the bill proposing the establishment of a public medical school, a key component of the Lee Jae-myung administration’s policy agenda to strengthen regional, essential, and public healthcare.However, even this remains uncertain. Holding a subcommittee meeting solely by the ruling party to review and pass bills could face opposition from the opposition party later and could escalate conflict between the ruling and opposition parties within the Welfare Committee.As a result, the schedule for the Welfare Committee's bill subcommittees has been disrupted due to clashes between the ruling and opposition parties over the third amendment to the Commercial Act, which primarily concerns mandatory retirement of treasury shares, judicial reform bills, and the Special Act on Administrative Integration.An official from the Democratic Party's Welfare Committee office said, “While the Subcommittee 2 (chaired by the Democratic Party) might be able to convene with the ruling party alone, Subcommittee 1 appears difficult to hold. There have been suggestions to conduct an article-by-article review of Subcommittee 1 bills at the plenary session level, but the political burden is considerable.”