- LOGIN

- MemberShip

- 2026-03-10 07:44:42

- The evolution of next-gen cancer drugs continues

- by Son, Hyung Min | translator | 2026-01-15 08:47:42

If cytotoxic chemotherapy, targeted therapies, and immuno-oncology drugs once reshaped the cancer treatment paradigm, the latest trends in anticancer drug development are rapidly shifting toward next-generation approaches.

The focus has moved toward more precise targeting strategies that improve efficacy while minimizing damage to normal tissues. In this process, antibody–drug conjugates (ADCs), bispecific and multispecific antibodies, and radiopharmaceuticals have emerged as core modalities in oncology R&D.

Furthermore, the development axis is expanding to include targeted protein degraders (TPDs) and cell and gene therapies (CGTs). Consequently, the competition for new oncology drugs is no longer just about individual drugs; it is being restructured into a competition of modalities, encompassing platforms and delivery technologies.

This shift is not merely a trend; it also represents the direction of R&D capital allocation, on how global pharmaceutical companies are simultaneously concentrating their M&A, licensing, and partnerships.

This shift extends beyond technological trends, as confirmed by where global capital and transactions are actually concentrated. According to the market research institution Evaluate, the global prescription drug market is projected to reach USD 1.7 trillion by 2030, with growth driven by emerging modalities such as ADCs, multispecific antibodies, RNA-based therapies, gene and cell therapies, and radiopharmaceuticals.

Ultimately, from the perspective of big pharma, the growth axis in oncology over the next decade must be designed not by filling pipelines one indication at a time, but by preemptively securing platforms that can be expanded across multiple cancer types upon commercialization.

DailPharm examined how the oncology development landscape is being reshaped around ADCs, bispecific antibodies, and radiopharmaceuticals, modalities that have already proven their market impact.

Precision drug delivery becomes standard therapy... ADC market competition intensifies

The first modality to drive market momentum has been ADCs. ADCs are therapeutics designed to deliver cytotoxic drugs (payloads) more selectively to tumors. They do this by linking the payload to an antibody that binds to specific antigens on the surface of cancer cells via a linker. This precision delivery strategy combines the selectivity of targeted therapies with the killing power of chemotherapy while minimizing damage to normal cells.

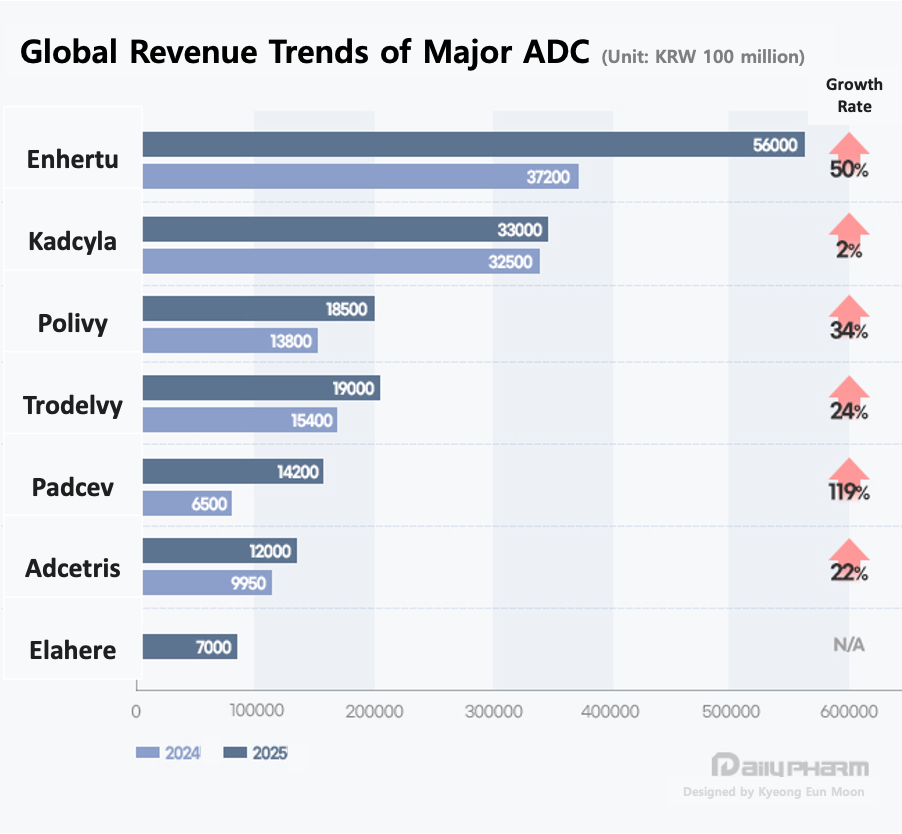

The drug symbolizing this field is Daiichi Sankyo and AstraZeneca's ‘Enhertu (trastuzumab deruxtecan)’. Enhertu's sales surged from KRW 3.72 trillion in 2023 to approximately KRW 5.6 trillion in 2024, proving that ADCs can evolve into blockbuster therapies rather than remain as late-line treatment options.

Enhertu’s expansion across breast, gastric, and non-small cell lung cancer demonstrates the core strength of ADC platforms. Once the delivery system gains clinical trust, pipeline value can grow exponentially through indication expansion. Enhertu has already achieved standard-of-care status in each of its approved indications.

Following HER2, the market's focus has shifted to another target, with TROP-2 taking center stage. The emergence of Daiichi Sankyo and AstraZeneca's Datroway (datopotamab deruxtecan) and Gilead’s Trodelvy (sacituzumab govitecan) has reinforced market confidence through strong sales growth.

Trodelvy grew 24% year-over-year from USD 1.063 billion in 2023 to USD 1.315 billion in 2024. This signifies that TROP-2-targeted ADCs have moved beyond potential and are now being validated through actual prescriptions and sales. Notably, they have demonstrated consecutive successes in HR+/HER2- and triple-negative breast cancer.

The reason ADCs are no longer just hit products for specific companies but have become a competitive axis across the entire industry lies in their high technological barriers and scalability. Given the complex combination of antibody, platform, linker, and payload required, it is difficult to solve all the puzzles through in-house development alone.

Consequently, global pharmaceutical companies are adopting a strategy of concurrently pursuing acquisitions, partnerships, and licensing to rapidly internalize proven components. Payload competition has also intensified. While microtubule inhibitors (Microtubule-disrupting agent Monomethyl Auristatin E, MMAE) dominated early ADCs, topoisomerase-1 (TOP1) inhibitor payloads are now expanding. Meanwhile, drugs like Astellas’ Padcev (enfortumab vedotin) continue to leverage MMAE payloads in combination with immunotherapy to seek synergies.

Ultimately, the decisive factor for ADCs is shifting from the fundamental skill of precise delivery to how rapidly they can expand indications and combination therapies.

Bispecific antibodies expand from blood cancers to solid tumors … multispecific antibodies enter the arena

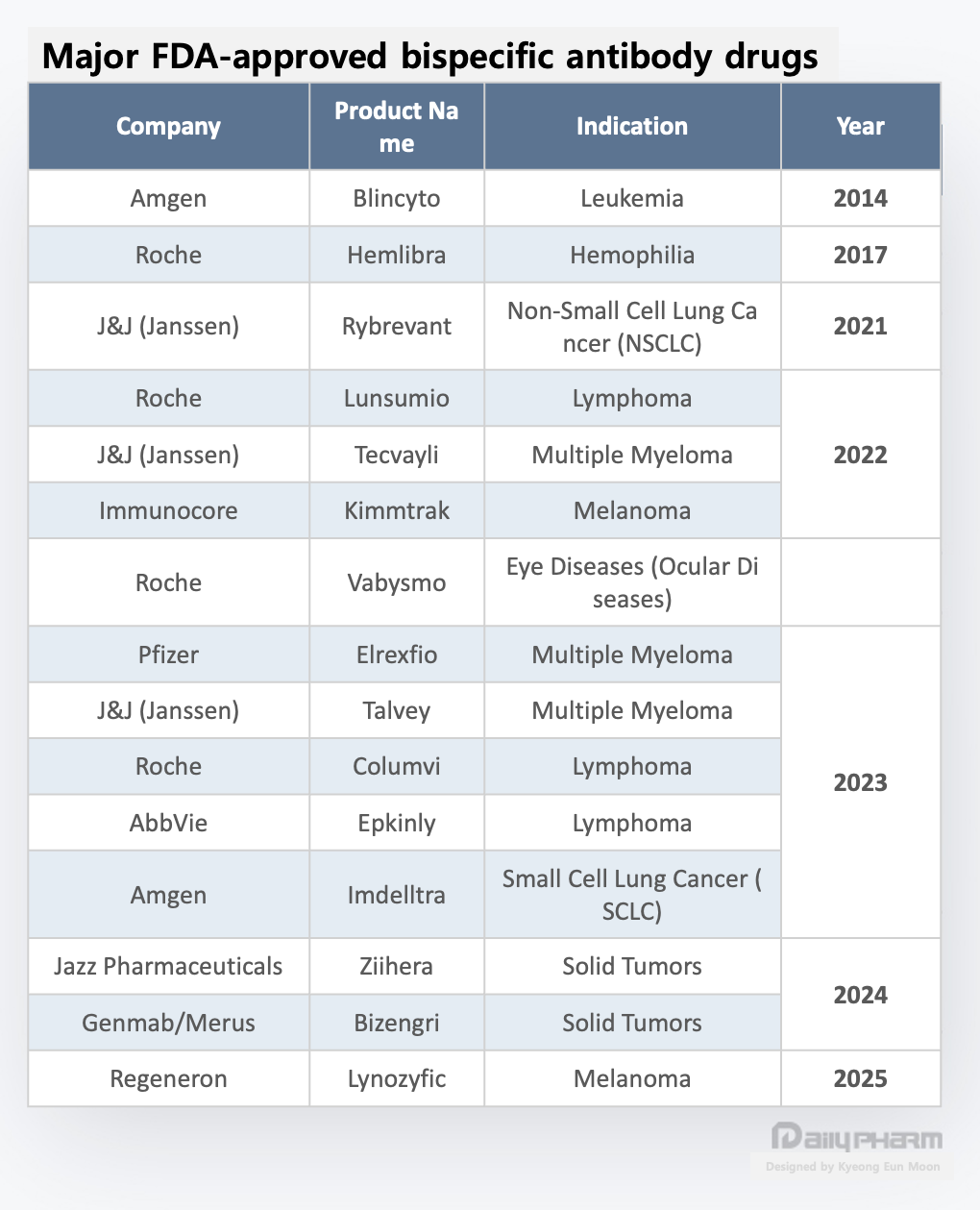

Bispecific and multispecific antibodies represent the next evolutionary stage of antibody-based cancer therapy.

Early development focused primarily on hematologic malignancies, where redirecting T cells toward tumor cells is easier to implement, and clinical efficacy can be demonstrated more rapidly.

Starting with Amgen’s Blincyto (blinatumomab), followed by Roche’s Lunsumio (mosunetuzumab) and Columvi (glofitamab), Johnson & Johnson’s Tecvayli (teclistamab) and Talvey (talquetamab), and AbbVie’s Epkinly (epcoritamab), most bispecific antibodies initially gained approval in blood cancers.

However, the landscape is changing. Leveraging accumulated clinical experience and manufacturing know-how, bispecific antibodies are now expanding into solid tumors.

Solid tumors have long been considered a challenging domain due to their complex tumor microenvironment (TME), limited immune cell infiltration, and the difficulty of managing toxicity in normal tissues. Nevertheless, some bispecific antibodies gained approval or entered late-stage clinical trials for solid tumors, signaling that bispecific platforms are no longer confined to hematologic malignancies.

Some experts interpret this as a process where bispecific antibodies are establishing themselves not as a technology for a single indication, but as an anti-cancer platform premised on indication expansion.

The fundamental concept of bispecific antibodies lies in simultaneously targeting two different targets. They adopt a structure where a single antibody binds to two different antigens, or simultaneously binds to two different epitopes on the same antigen.

This enables the simultaneous pursuit of increased binding affinity, enhanced signal blockade, and immune cell induction effects, which are outcomes difficult to achieve with monoclonal antibodies alone. Particularly in oncology, the core strategy involves simultaneously capturing tumor cell antigens and immune cell antigens to direct the immune response to the tumor site.

Recently, pharmaceutical companies globally have begun actively developing multispecific antibodies that target three antigens simultaneously, beyond bispecific antibodies. This is not merely about adding one more target; it represents an attempt to combine elements like tumor targeting, immune activation, and immune checkpoint inhibition within a single molecule to achieve more sophisticated immune modulation.

This approach aims to embed the combination strategy using immuno-oncology drugs within a single molecule. If successful, it is expected to simultaneously enhance treatment convenience and efficacy.

Another reason multispecific antibodies are gaining attention is their potential to cross the blood-brain barrier (BBB). The BBB is considered a major challenge in anticancer drug development. While drug delivery to the brain is critical for treating CNS metastases or primary brain tumors, most antibodies and small-molecule drugs face limitations in crossing the BBB.

Multispecific antibodies offer the potential to cross the BBB via receptor-mediated transcytosis by incorporating structures that bind to specific receptors present on the BBB surface. Consequently, they are also gaining attention as a next-generation anticancer strategy targeting CNS tumors or brain metastases.

Furthermore, recent antibody designs increasingly combine antibodies that bind to antigens regulating immune cell activity with those that bind tumor-specific antigens. This aims to enhance immune activation while reducing non-specific toxicity.

For example, one approach targets both antigens regulating T-cell activation signals and tumor-specific antigens simultaneously. This design amplifies immune responses exclusively within the tumor microenvironment. This represents an attempt to structurally mitigate the systemic toxicity issues of existing immune checkpoint inhibitors and is considered a particularly meaningful approach in the field of solid tumors.

In summary, bispecific and multispecific antibodies are no longer technologies confined to hematologic malignancies. Building on validated mechanisms and clinical experience in blood cancers, the field has entered a stage of actively pursuing indication expansion into solid tumors.

Simultaneously, the evolution of antibody-based anticancer platforms is evident through the addition of multi-target strategies, including triple antibodies, BBB-permeable designs, and precision-linking structures between immune cells and tumor cells. This symbolically demonstrates that anticancer therapy is moving beyond the era of targeting single targets, advancing to a sophisticated stage where tumors, immunity, and delivery pathways are designed simultaneously.

Radiopharmaceuticals: from diagnosis to therapy… big pharma M&A fuels growth

The third major oncology R&D axis is radiopharmaceuticals. This approach involves administering compounds conjugated with radioactive isotopes, which reach the target and then emit radiation to damage the tumor. The shift of a market historically dominated by diagnostics toward therapeutic applications represents one of the most dramatic changes in recent years.

While estimates from market research institutions vary, the consensus is that the radiopharmaceutical market will expand over the medium to long term. Some reports even suggest it could grow to around USD 10 billion this year. More significant than the numbers is that this growth expectation is actually triggering M&A and partnerships among multinational pharmaceutical companies.

With beta-particle-based ligand therapies now on the track to commercialization, the global industry is shifting its focus to alpha-particle-based therapies, which offer higher energy, shorter range, and more precise killing power.

Leading candidates include Actinium-225 and Astatine-211. These are gaining attention as next-generation targeted therapies because they possess a shorter range and higher LET (Linear Energy Transfer) compared to the existing beta-particle-based lutetium-177. This allows for precise targeting of cancer cells while minimizing damage to surrounding healthy tissue.

Novartis, developer of Lutathera and Pluvicto, acquired radiopharma developer Mariana. AstraZeneca partnered with Fusion Pharmaceuticals. The US, Canada, and Europe are already treating the securing of actinium production and purification infrastructure as a national-level strategy.

BMS acquired RayzeBio for USD 4.1 billion in late 2023 and formalized the completion of the acquisition in February 2024, integrating the radiopharmaceutical platform into the group.

Notably, Lilly signed a joint development agreement with Aktis Oncology even after acquiring Point Biopharma. Recently, Lilly participated as an anchor investor in Aktis’ IPO process, reaffirming its commitment to positioning radiopharmaceuticals as a long-term growth pillar. Through the PointBio acquisition, Lilly secured the prostate cancer treatment candidate PNT2002 and the neuroendocrine tumor treatment candidate PNT2003.

Radiopharmaceuticals are attractive because they enable indication expansion through combinations of targets (ligands/antibodies) and isotopes. Furthermore, if a value chain extending from diagnosis to therapy (theranostics) is established, platform lock-in effects can be anticipated.

Simultaneously, the demanding industrial infrastructure requirements, including isotope supply chains, manufacturing (CMC), logistics, and administration infrastructure, are interpreted as driving a stronger tendency among global pharmaceutical companies to internalize capabilities through acquisitions rather than simple partnerships.

Ultimately, the rapid reshaping of the oncology development landscape is not merely a succession of individual companies launching new drugs. While ADCs offer precision delivery, bispecific antibodies provide multi-target and immune engagement, and radiopharmaceuticals deliver targeted radiation. Each presents distinct solutions, but all believe that those possessing platforms are required to design the next pipeline.

If cytotoxic, targeted, and immuno-oncology therapies formed the major pillars of treatment, the decisive factor now is securing which modality on that foundation and expanding it quickly. The success or failure of R&D hinges not on individual compounds but on modality (platform) competitiveness. Big pharma's acquisitions, investments, and technology deals signal that this competition is already fully underway.

-

- 0

댓글 운영방식은

댓글은 실명게재와 익명게재 방식이 있으며, 실명은 이름과 아이디가 노출됩니다. 익명은 필명으로 등록 가능하며, 대댓글은 익명으로 등록 가능합니다.

댓글 노출방식은

댓글 명예자문위원(팜-코니언-필기모양 아이콘)으로 위촉된 데일리팜 회원의 댓글은 ‘게시판형 보기’와 ’펼쳐보기형’ 리스트에서 항상 최상단에 노출됩니다. 새로운 댓글을 올리는 일반회원은 ‘게시판형’과 ‘펼쳐보기형’ 모두 팜코니언 회원이 쓴 댓글의 하단에 실시간 노출됩니다.

댓글의 삭제 기준은

다음의 경우 사전 통보없이 삭제하고 아이디 이용정지 또는 영구 가입제한이 될 수도 있습니다.

-

저작권·인격권 등 타인의 권리를 침해하는 경우

상용 프로그램의 등록과 게재, 배포를 안내하는 게시물

타인 또는 제3자의 저작권 및 기타 권리를 침해한 내용을 담은 게시물

-

근거 없는 비방·명예를 훼손하는 게시물

특정 이용자 및 개인에 대한 인신 공격적인 내용의 글 및 직접적인 욕설이 사용된 경우

특정 지역 및 종교간의 감정대립을 조장하는 내용

사실 확인이 안된 소문을 유포 시키는 경우

욕설과 비어, 속어를 담은 내용

정당법 및 공직선거법, 관계 법령에 저촉되는 경우(선관위 요청 시 즉시 삭제)

특정 지역이나 단체를 비하하는 경우

특정인의 명예를 훼손하여 해당인이 삭제를 요청하는 경우

특정인의 개인정보(주민등록번호, 전화, 상세주소 등)를 무단으로 게시하는 경우

타인의 ID 혹은 닉네임을 도용하는 경우

-

게시판 특성상 제한되는 내용

서비스 주제와 맞지 않는 내용의 글을 게재한 경우

동일 내용의 연속 게재 및 여러 기사에 중복 게재한 경우

부분적으로 변경하여 반복 게재하는 경우도 포함

제목과 관련 없는 내용의 게시물, 제목과 본문이 무관한 경우

돈벌기 및 직·간접 상업적 목적의 내용이 포함된 게시물

게시물 읽기 유도 등을 위해 내용과 무관한 제목을 사용한 경우

-

수사기관 등의 공식적인 요청이 있는 경우

-

기타사항

각 서비스의 필요성에 따라 미리 공지한 경우

기타 법률에 저촉되는 정보 게재를 목적으로 할 경우

기타 원만한 운영을 위해 운영자가 필요하다고 판단되는 내용

-

사실 관계 확인 후 삭제

저작권자로부터 허락받지 않은 내용을 무단 게재, 복제, 배포하는 경우

타인의 초상권을 침해하거나 개인정보를 유출하는 경우

당사에 제공한 이용자의 정보가 허위인 경우 (타인의 ID, 비밀번호 도용 등)

※이상의 내용중 일부 사항에 적용될 경우 이용약관 및 관련 법률에 의해 제재를 받으실 수도 있으며, 민·형사상 처벌을 받을 수도 있습니다.

※위에 명시되지 않은 내용이더라도 불법적인 내용으로 판단되거나 데일리팜 서비스에 바람직하지 않다고 판단되는 경우는 선 조치 이후 본 관리 기준을 수정 공시하겠습니다.

※기타 문의 사항은 데일리팜 운영자에게 연락주십시오. 메일 주소는 dailypharm@dailypharm.com입니다.