- LOGIN

- MemberShip

- 2026-03-10 10:13:26

- Global pharma R&D direction based on M&A trend

- by Son, Hyung Min | translator | 2026-01-14 09:32:06

Mergers and acquisitions (M&A) have become a survival strategy in the pharmaceutical industry.

Throughout 2025, the M&A trends of global pharmaceutical companies revealed not just simple acquisitions, but the very direction of R&D aimed at securing future growth engines.

As pipeline acquisition, platform technology integration, and rapid clinical capability building have become central to M&A strategies, R&D planning is undergoing a structural transformation.

As of 2026, these changes have become even more pronounced. In oncology drug development, new mechanisms such as radiopharmaceuticals, antibody-drug conjugates (ADCs), and multispecific antibodies are rapidly emerging and swiftly replacing existing standard treatment areas.

Another key growth axis is metabolic disease. GLP-1-based novel drugs, which have led the obesity treatment market, are now evolving beyond simple weight loss into metabolic platform therapies encompassing cardiovascular, renal, and hepatic diseases. This shift in the obesity treatment paradigm is ultimately redefining therapeutic strategies for metabolic diseases overall and rewriting the expansion potential of the global market.

In this feature, DailyPharm will examine ▲R&D strategies revealed through 2025 M&A trends ▲the rapid reshaping of the oncology development landscape ▲and the expanding innovation driven by GLP-1–based metabolic therapies, in order to forecast the future direction of global R&D paradigms.

The return of major deals…2025 emphasized direction over scale

Looking at major M&A deals closed last year, the largest was Johnson & Johnson's USD 14.6 billion (approximately KRW 21 trillion) acquisition of US biopharmaceutical company Intracellular Therapies.

Through this acquisition, J&J added the FDA-approved schizophrenia and bipolar disorder treatment Caplyta (lumateperone) to its pipeline. Caplyta is characterized by high serotonin 5-HT2A receptor occupancy and low dopamine D2 receptor occupancy. These features serve as important benchmarks in selective neurotransmitter targeting and drug development. J&J projected Caplyta to generate annual sales exceeding USD 5 billion.

Other mega-deals exceeding USD 10 billion included Novartis’ acquisition of RNA therapeutics company Avidity Biosciences (USD 12 billion) and Pfizer’s acquisition of Metsera (USD 10 billion) to secure GLP-1–based candidates.

A common theme across these transactions is their focus on next-generation platforms and pipeline scalability rather than short-term revenue expansion.

CNS, RNA therapeutics, GLP-1 class drugs, and metabolic dysfunction-associated steatohepatitis (MASH) are all considered areas with significant potential impact upon clinical success and ease of indication expansion.

This signals that Big Pharmas are prioritizing and concentrating on certain future markets amid a global environment of heightened uncertainty.

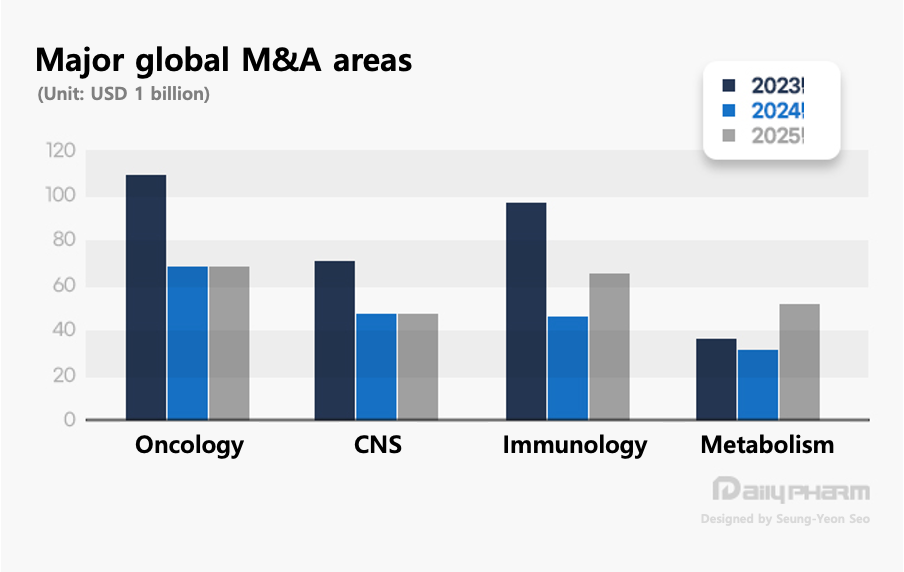

Looking at investment trends by disease area, oncology still holds the largest share, but its growth has slowed.

According to data from market research firm EY, the size of oncology-related M&A reached approximately USD 109 billion in 2023 but plummeted to USD 68 billion in 2024. Last year, it increased to USD 95 billion, driven by global pharmaceutical companies introducing new drugs with novel mechanisms of action.

This trend reflects not a contraction in oncology R&D, but rather the fact that new mechanisms such as ADCs, radiopharmaceuticals, and multispecific antibodies have already been largely absorbed into the internal pipelines of large companies.

In other words, the analysis suggests that in the oncology field, strategic alliances or joint development at the technology platform level are now preferred over acquiring individual candidate compounds.

Conversely, the CNS sector showed relatively stable investment flows. This, including Johnson & Johnson's major deal, demonstrates that central nervous system disorders are still recognized as an area with both long-term growth potential and unmet medical needs. Many global pharmaceutical companies are shifting their portfolios to focus on rare immune diseases.

The most notable change in 2025 M&A is the resurgence of immunology and metabolic disease sectors. Deal size for immunology rose from USD 46 billion in 2024 to USD 65 billion in 2025, while metabolic disease expanded from USD 31 billion to USD 51 billion over the same period.

Notably, Novo Nordisk's acquisition of Akero (USD 5.2 billion) and Roche's acquisition of 89bio (USD 3.5 billion) were both transactions aimed at securing metabolic disease pipelines, including MASH.

This clearly demonstrates that GLP-1-based obesity treatments are evolving into a platform therapeutic strategy extending beyond simple weight loss to target cardiovascular, hepatic, and renal diseases. Some analysts suggest the next stage of obesity drug competition will be a battle spanning the entire metabolic disease spectrum.

Refined new drug development strategies amid persistent uncertainty

The global pharmaceutical industry’s M&A activity in 2025 is widely regarded as a year that clearly revealed mid- to long-term R&D strategy direction rather than simple scale expansion.

Considering both deal size and target disease portfolios, global pharmaceutical companies embarked on structural reorganization to secure platform technologies and future therapeutic areas, going beyond merely bolstering individual pipelines.

However, the most significant characteristic of the M&A deals concluded in 2025 was the shift in focus away from aggressive acquisitions centered on anticancer drugs, as seen in the past, towards areas with relatively assured long-term growth potential, such as metabolic diseases, CNS, and rare diseases.

Furthermore, last year's M&A trends show a clearer strategic focus compared to the previous year.

The largest deal concluded in the global pharmaceutical industry in 2024 was Vertex Pharmaceuticals' acquisition of Alpine Immune Sciences for USD 4.9 billion (approximately KRW 7.03 trillion). This is a significantly smaller scale compared to the multiple USD 10 billion-plus deals of 2023.

The 2024 M&A market is generally assessed as a year dominated by caution toward large acquisitions. Global pharmaceutical companies opted for a strategy of selectively acquiring relatively smaller companies instead of making big bets like in the past, then growing their corporate value through internal capabilities.

This is the so-called ‘bolt-on strategy’. This approach involves acquiring small-to-mid-sized biotech companies possessing core platforms or promising pipelines, then combining them with in-house R&D, clinical, and commercialization capabilities. This method disperses risk while incrementally increasing the likelihood of success.

Against this backdrop, the resurgence of multiple USD 10 billion-plus deals in 2025 suggests that global pharmaceutical companies are moving from a phase of uncertainty into one of selective conviction.

However, unlike in 2023, capital is no longer being deployed indiscriminately. Investment is now concentrated solely in disease areas, mechanisms, and platforms that have been clearly validated, signaling that the nature of M&A itself has become far more sophisticated.

-

- 1

댓글 운영방식은

댓글은 실명게재와 익명게재 방식이 있으며, 실명은 이름과 아이디가 노출됩니다. 익명은 필명으로 등록 가능하며, 대댓글은 익명으로 등록 가능합니다.

댓글 노출방식은

댓글 명예자문위원(팜-코니언-필기모양 아이콘)으로 위촉된 데일리팜 회원의 댓글은 ‘게시판형 보기’와 ’펼쳐보기형’ 리스트에서 항상 최상단에 노출됩니다. 새로운 댓글을 올리는 일반회원은 ‘게시판형’과 ‘펼쳐보기형’ 모두 팜코니언 회원이 쓴 댓글의 하단에 실시간 노출됩니다.

댓글의 삭제 기준은

다음의 경우 사전 통보없이 삭제하고 아이디 이용정지 또는 영구 가입제한이 될 수도 있습니다.

-

저작권·인격권 등 타인의 권리를 침해하는 경우

상용 프로그램의 등록과 게재, 배포를 안내하는 게시물

타인 또는 제3자의 저작권 및 기타 권리를 침해한 내용을 담은 게시물

-

근거 없는 비방·명예를 훼손하는 게시물

특정 이용자 및 개인에 대한 인신 공격적인 내용의 글 및 직접적인 욕설이 사용된 경우

특정 지역 및 종교간의 감정대립을 조장하는 내용

사실 확인이 안된 소문을 유포 시키는 경우

욕설과 비어, 속어를 담은 내용

정당법 및 공직선거법, 관계 법령에 저촉되는 경우(선관위 요청 시 즉시 삭제)

특정 지역이나 단체를 비하하는 경우

특정인의 명예를 훼손하여 해당인이 삭제를 요청하는 경우

특정인의 개인정보(주민등록번호, 전화, 상세주소 등)를 무단으로 게시하는 경우

타인의 ID 혹은 닉네임을 도용하는 경우

-

게시판 특성상 제한되는 내용

서비스 주제와 맞지 않는 내용의 글을 게재한 경우

동일 내용의 연속 게재 및 여러 기사에 중복 게재한 경우

부분적으로 변경하여 반복 게재하는 경우도 포함

제목과 관련 없는 내용의 게시물, 제목과 본문이 무관한 경우

돈벌기 및 직·간접 상업적 목적의 내용이 포함된 게시물

게시물 읽기 유도 등을 위해 내용과 무관한 제목을 사용한 경우

-

수사기관 등의 공식적인 요청이 있는 경우

-

기타사항

각 서비스의 필요성에 따라 미리 공지한 경우

기타 법률에 저촉되는 정보 게재를 목적으로 할 경우

기타 원만한 운영을 위해 운영자가 필요하다고 판단되는 내용

-

사실 관계 확인 후 삭제

저작권자로부터 허락받지 않은 내용을 무단 게재, 복제, 배포하는 경우

타인의 초상권을 침해하거나 개인정보를 유출하는 경우

당사에 제공한 이용자의 정보가 허위인 경우 (타인의 ID, 비밀번호 도용 등)

※이상의 내용중 일부 사항에 적용될 경우 이용약관 및 관련 법률에 의해 제재를 받으실 수도 있으며, 민·형사상 처벌을 받을 수도 있습니다.

※위에 명시되지 않은 내용이더라도 불법적인 내용으로 판단되거나 데일리팜 서비스에 바람직하지 않다고 판단되는 경우는 선 조치 이후 본 관리 기준을 수정 공시하겠습니다.

※기타 문의 사항은 데일리팜 운영자에게 연락주십시오. 메일 주소는 dailypharm@dailypharm.com입니다.