- LOGIN

- MemberShip

- 2025-12-23 14:11:58

- K-Bios acquire US plants to mitigate tariff risks

- by Chon, Seung-Hyun | translator | 2025-12-23 08:00:02

Korea’s flagship biotech companies, Samsung Biologics and Celltrion, are moving in tandem to acquire manufacturing plants in the United States. Following Celltrion, Samsung Biologics has made a decisive move by acquiring a multinational pharmaceutical manufacturing facility with an investment exceeding KRW 400 billion. These two companies—Korea’s largest biotech exporters to the U.S.—are leveraging strong profitability to pursue large-scale mergers and acquisitions (M&A) as a preemptive strategy to mitigate tariff risks.

Samsung Biologics acquires GSK plant in the U.S. for KRW 410 billion...first overseas investment

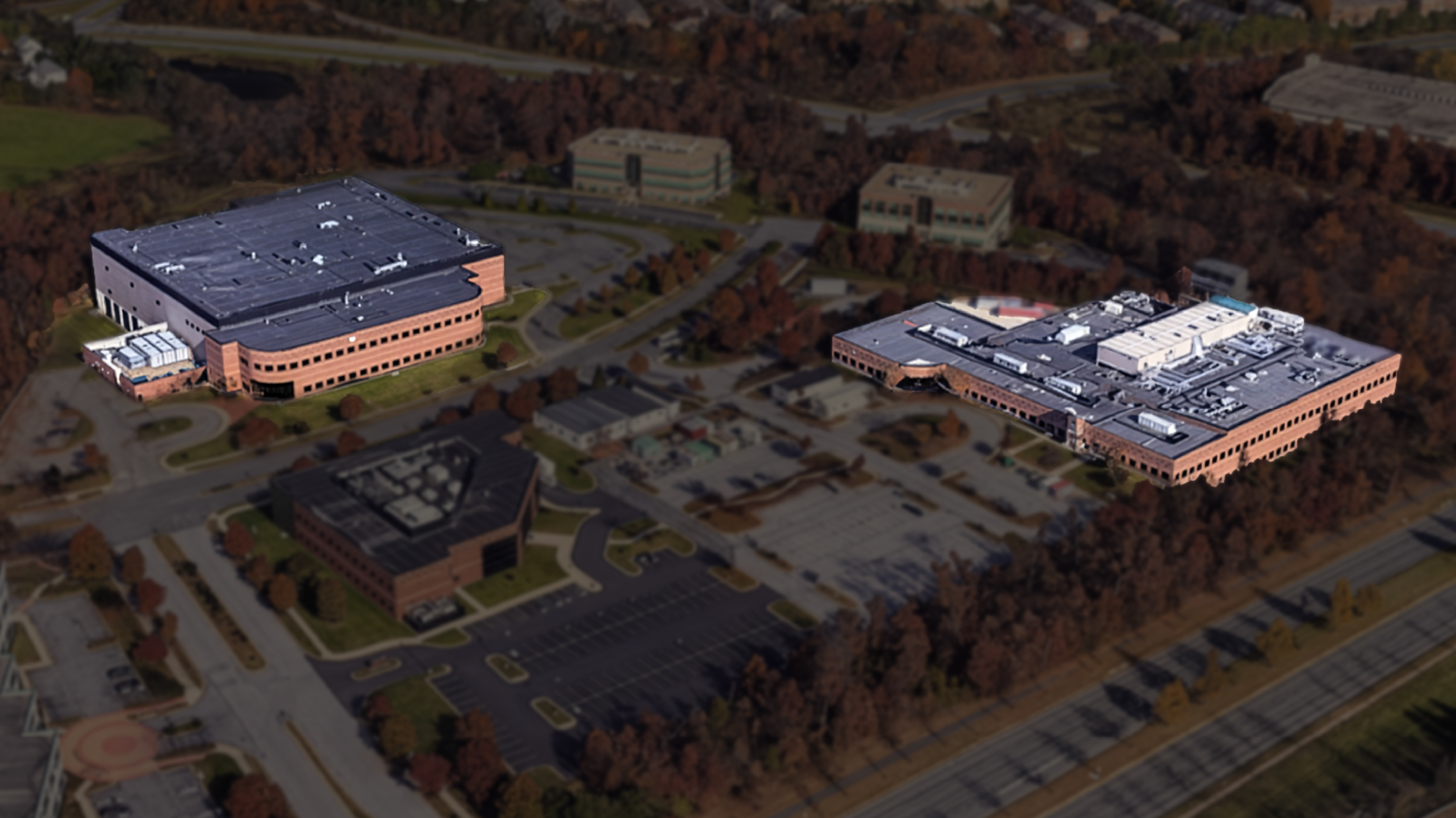

According to industry sources on the 22nd, Samsung Biologics signed an agreement with GSK to acquire a biologics manufacturing facility formerly operated by Human Genome Sciences (HGS), located in Rockville, Maryland. Samsung Biologics America, the U.S. subsidiary of Samsung Biologics, will invest $280 million (approximately 410 billion won) to acquire the facility. The asset acquisition process is expected to be completed within the first quarter of 2026.

The Rockville production facility is a 60,000-liter API manufacturing plant located in the heart of Maryland's biocluster. It consists of two manufacturing buildings. The facility is equipped with infrastructure capable of supporting antibody drug production at various scales, from clinical development to commercial manufacturing.

This marks Samsung Biologics' first overseas plant acquisition. Samsung Biologics currently operates five plants in Songdo, Incheon. All five plants were constructed using internally sourced funds.

Since its inception, Samsung Biologics has sequentially built Plant 1 (30,000 liters), Plant 2 (155,000 liters), and Plant 3 (180,000 liters). In October 2022, just 23 months after groundbreaking, it launched Plant 4, which boasts the world's largest manufacturing capacity (240,000 liters) for a single plant. With the start of operations at the 180,000-liter Plant 5 last April, Samsung Biologics' total manufacturing capacity expanded to 785,000 liters. Samsung Biologics invested KRW 5.9089 trillion in the construction of Plant 5.

The GSK plant Samsung Biologics is acquiring this time is not large in scale compared to the domestic plants it built itself or the investment amounts involved. Samsung Biologics invested over KRW 2 trillion each in the construction of Plants 4 and 5.

Samsung Biologics explained, “This acquisition establishes a dual-source production system connecting Songdo, Korea, and Rockville, USA, providing flexible and stable production options to global customers.” The company plans to expand its collaboration base with North American customers and enhance its ability to respond to regional supply environment changes, thereby further elevating its CDMO competitiveness.

Samsung Biologics' acquisition of the US plant is analyzed as a strategy to preemptively mitigate tariff risks.

South Korea and the U.S. agreed at the APEC summit in Gyeongju last October to apply Most-Favored-Nation (MFN) treatment in the pharmaceutical sector. This means domestically manufactured drugs in the U.S. will receive MFN treatment, similar to Japan and the EU, with tariffs capped at a maximum rate of 15%.

According to the detailed agreement released last month, the White House announced a Joint Fact Sheet (JFS) from the Korea-U.S. summit stating that tariffs on Korean pharmaceuticals would not exceed 15%. It was confirmed that any tariffs imposed on pharmaceuticals would not exceed a 15% tariff rate. Generic drugs would be subject to zero tariffs. Nevertheless, industry players note that future tariff uncertainties remain.

Celltrion acquires Lilly plant for KRW 460 billion... resolves tariff risk for top two U.S. exporters

From the perspective of domestic pharmaceutical and biotech companies, building factories locally in the U.S. is the most realistic and optimal strategy to eliminate tariff risk.

Celltrion has taken the most proactive steps in preparation for U.S. tariffs. In September, Celltrion USA, a subsidiary of Celltrion, signed a definitive agreement to acquire a biopharmaceutical manufacturing facility located in Branchburg, New Jersey, from ImClone Systems Holdings, a subsidiary of Eli Lilly. The acquisition price is approximately USD 330 million (about KRW 460 billion). In addition to the plant acquisition cost, Celltrion plans to invest a total of KRW 700 billion, including initial operating expenses.

Celltrion received approval from Ireland's competition authorities last October and completed the final review by the U.S. Federal Trade Commission (FTC) in November. These two reviews are key procedures where regulatory agencies assess whether combining corporate assets could harm market competition, representing the final hurdle determining the deal's success.

With these acquisitions, Korea’s leading biotech exporters have invested over KRW 1 trillion to secure U.S. production bases, effectively insulating themselves from tariff risks.

According to the Ministry of Food and Drug Safety (MFDS), Korean pharmaceutical exports to the U.S. reached USD 1.49 billion (approx. KRW 2 trillion) last year, accounting for 16.1% of Korea’s total USD 9.28987 billion pharmaceutical exports. Finished pharmaceutical products accounted for USD 1,298.99 million (87.1%), while active pharmaceutical ingredients (APIs) amounted to just USD 192.19 million (16.9%. Samsung Biologics and Celltrion dominate this export volume.

Samsung Biologics recorded US regional sales of KRW 1.1741 trillion out of its total sales of KRW 4.5473 trillion last year, representing 25.8%. The proportion of Samsung Biologics' sales to the US was 28.5% in 2022 and 26.3% in 2023. Samsung Biologics calculates regional sales based on the location of its CDMO clients. Its cumulative third-quarter U.S. sales reached KRW 1.6482 trillion, already surpassing last year's total exports. U.S. sales accounted for 38.8% of Samsung Biologics' cumulative third-quarter revenue of KRW 4.2484 trillion.

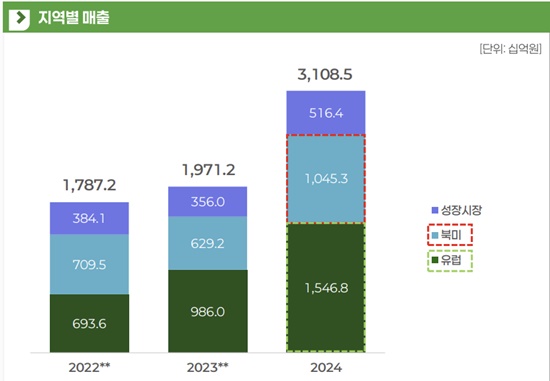

Celltrion has secured 11 FDA approvals in the U.S. Its North American biologics revenue reached KRW 1.045 trillion last year. While Celltrion's North American sales decreased by 11.3% from KRW 709.5 billion in 2022 to KRW 629.2 billion in 2023, they surged 66.1% year-on-year last year, surpassing KRW 1 trillion for the first time. In Q3 alone this year, North American exports surged to KRW 265 billion, more than three times the figure from the same period last year, driven by biosimilar expansion and preemptive shipments ahead of tariff risks.

Securing new revenue streams through U.S. manufacturing bases... Generous investments with cash accumulated from high-purity performance

Both Samsung Biologics and Celltrion avoided tariff risks while securing new revenue streams by establishing U.S. manufacturing bases.

Samsung Biologics acquired the Rockville production facility, inheriting contracts for existing products manufactured there and securing a stable supply of large-scale contract manufacturing (CMO) volumes. The company explained that by retaining all 500+ local employees with operational experience and expertise, it established a system that preserves manufacturing continuity and operational stability post-acquisition.

Celltrion secured a stable revenue base from the outset by acquiring Lilly's plant and taking over the existing CMO volume of active pharmaceutical ingredients (APIs) previously produced by Lilly. Celltrion anticipates that once the manufacturing line conversion is completed, following post-acquisition validation and re-approval procedures, full-scale production of its own products and CMO volume supply to Lilly will commence next year. This is expected to yield tangible results, structurally mitigating U.S. tariff risks while improving manufacturing efficiency and expanding profitability.

Samsung Biologics and Celltrion were able to flexibly secure U.S. manufacturing bases thanks to cash reserves accumulated through high performance.

Samsung Biologics recorded cumulative sales of KRW 4.2484 trillion and operating profit of KRW 1.6911 trillion during the first three quarters of this year. Its operating profit margin reached 39.8% relative to sales. Samsung Biologics held KRW 922.1 billion in cash and cash equivalents as of the end of the third quarter.

Celltrion posted cumulative sales of KRW 2.8323 trillion and operating profit of KRW 693.3 billion for the first three quarters of this year. This represents an operating profit margin of 24.5%. Celltrion's cash and cash equivalents totaled KRW 810 billion as of the end of the third quarter.

-

- 0

댓글 운영방식은

댓글은 실명게재와 익명게재 방식이 있으며, 실명은 이름과 아이디가 노출됩니다. 익명은 필명으로 등록 가능하며, 대댓글은 익명으로 등록 가능합니다.

댓글 노출방식은

댓글 명예자문위원(팜-코니언-필기모양 아이콘)으로 위촉된 데일리팜 회원의 댓글은 ‘게시판형 보기’와 ’펼쳐보기형’ 리스트에서 항상 최상단에 노출됩니다. 새로운 댓글을 올리는 일반회원은 ‘게시판형’과 ‘펼쳐보기형’ 모두 팜코니언 회원이 쓴 댓글의 하단에 실시간 노출됩니다.

댓글의 삭제 기준은

다음의 경우 사전 통보없이 삭제하고 아이디 이용정지 또는 영구 가입제한이 될 수도 있습니다.

-

저작권·인격권 등 타인의 권리를 침해하는 경우

상용 프로그램의 등록과 게재, 배포를 안내하는 게시물

타인 또는 제3자의 저작권 및 기타 권리를 침해한 내용을 담은 게시물

-

근거 없는 비방·명예를 훼손하는 게시물

특정 이용자 및 개인에 대한 인신 공격적인 내용의 글 및 직접적인 욕설이 사용된 경우

특정 지역 및 종교간의 감정대립을 조장하는 내용

사실 확인이 안된 소문을 유포 시키는 경우

욕설과 비어, 속어를 담은 내용

정당법 및 공직선거법, 관계 법령에 저촉되는 경우(선관위 요청 시 즉시 삭제)

특정 지역이나 단체를 비하하는 경우

특정인의 명예를 훼손하여 해당인이 삭제를 요청하는 경우

특정인의 개인정보(주민등록번호, 전화, 상세주소 등)를 무단으로 게시하는 경우

타인의 ID 혹은 닉네임을 도용하는 경우

-

게시판 특성상 제한되는 내용

서비스 주제와 맞지 않는 내용의 글을 게재한 경우

동일 내용의 연속 게재 및 여러 기사에 중복 게재한 경우

부분적으로 변경하여 반복 게재하는 경우도 포함

제목과 관련 없는 내용의 게시물, 제목과 본문이 무관한 경우

돈벌기 및 직·간접 상업적 목적의 내용이 포함된 게시물

게시물 읽기 유도 등을 위해 내용과 무관한 제목을 사용한 경우

-

수사기관 등의 공식적인 요청이 있는 경우

-

기타사항

각 서비스의 필요성에 따라 미리 공지한 경우

기타 법률에 저촉되는 정보 게재를 목적으로 할 경우

기타 원만한 운영을 위해 운영자가 필요하다고 판단되는 내용

-

사실 관계 확인 후 삭제

저작권자로부터 허락받지 않은 내용을 무단 게재, 복제, 배포하는 경우

타인의 초상권을 침해하거나 개인정보를 유출하는 경우

당사에 제공한 이용자의 정보가 허위인 경우 (타인의 ID, 비밀번호 도용 등)

※이상의 내용중 일부 사항에 적용될 경우 이용약관 및 관련 법률에 의해 제재를 받으실 수도 있으며, 민·형사상 처벌을 받을 수도 있습니다.

※위에 명시되지 않은 내용이더라도 불법적인 내용으로 판단되거나 데일리팜 서비스에 바람직하지 않다고 판단되는 경우는 선 조치 이후 본 관리 기준을 수정 공시하겠습니다.

※기타 문의 사항은 데일리팜 운영자에게 연락주십시오. 메일 주소는 dailypharm@dailypharm.com입니다.